Stay up to date with the latest CRE market reports, trends and events.

Industrial Vacancies Normalize as High Inflation and Costs Slow Demand

The U.S. industrial vacancy rate was 5.2% at the end of April, unchanged month-over-month as demand for space has been moderating.

Commercial Property Classifications by Use Type of Office Spaces and Building Classes

Office buildings are divided into multiple categories based on their use type of office space as well as age, location, and amenities.

The Distressed Office Market Continues to Unfold Amid Stagnating Demand and Falling Property Values

In March, several markets had average DSCRs below 1.0, including Brooklyn (0.81), Chicago (0.90) and Cleveland (0.96), CommercialEdge shows.

6 Ways Real Estate Maps Can Reveal Trends, Opportunities and Risks

Real estate maps can be used in portfolio management, market analysis, site selection and risk assessment, among others.

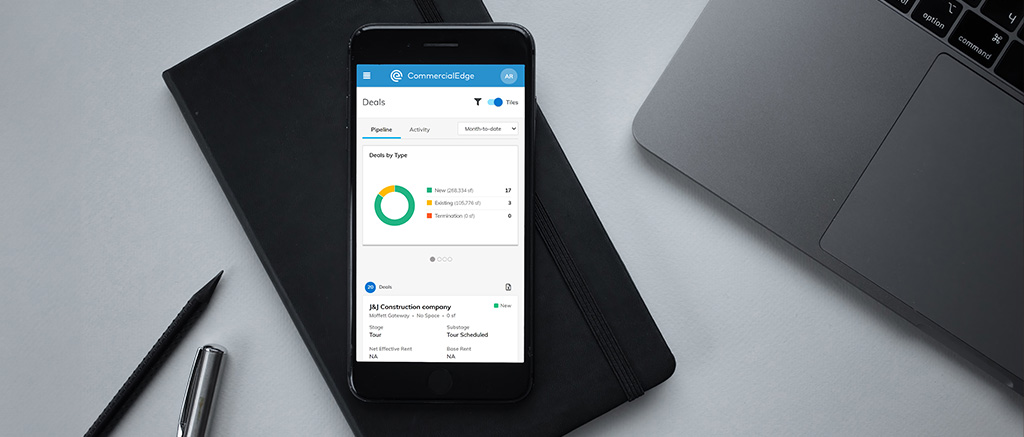

Transform CRE Listing Agreement Management with Deal Manager

Deal Manager simplifies the process and prevents missed opportunities by tracking and managing listing agreements in one connected platform.

Historic Levels of New Supply Push Industrial Vacancy Rates Higher in Q1 2024

The industrial vacancy rate was 5.2% in March across the U.S., up 20 basis points from the previous month.

How to Find Mixed-Use Property for Sale

Learn how to find mixed-use properties for sale with minimal effort and capitalize on these investment opportunities.

Q1 2024 Office Sales Dip to $5.4 Billion, 17% Below Last Year’s Figure

Office sales continued to wane in Q1 2024 as companies embraced remote and hybrid work and re-examined their office footprints.

Enhanced Efficiency Through Seamless Commissions and Yardi Voyager Integration

The Commissions and Yardi Voyager integration allows for flexible, automated workflows with real-time data synchronization.

How to Calculate DSCR (Debt Service Coverage Ratio) in Commercial Real Estate

A comprehensive guide on how to calculate debt service coverage ratio and use it for investment analysis and decision-making.

Industrial Sale Prices Hold Firm Amid Normalizing Demand and Shifting Capital Markets

Despite the decline in sales over recent quarters, the average sale price of industrial properties has remained high, increasing by 9.6% quarter-over-quarter and 2.0% year-over-year.