Key Marketing Strategies for Boosting Industrial Listing Visibility

Note: Article updated in April 2024.

As demand for industrial space shifts and adapts, investor and tenant interest in well-positioned industrial properties continues to be elevated as vacancy remains tight. With ongoing competition surrounding industrial space for lease and for sale, listings should be promoted with a well-established marketing strategy that delivers the property’s unique selling points to the appropriate audience.

Relevant Details to Consider

Location should be highlighted immediately on a listing, as this information guides prospects in determining if the property is suitable for their operational requirements. To that end, interactive location maps are an important feature for highlighting the property’s proximity to:

- Business corridors

- Transportation nodes

- Major thoroughfares

- Airport, rail and port access

- Distribution hubs

- Mass transit

- Residential communities

- Local amenities

Zoning status is another relevant detail to specify. Depending on the facility’s sub-type, certain industrial properties may not be zoned to support every industrial operation. Building specifications not only help prospects narrow down their research but also provide a clear image of the building’s main characteristics, and these details are referenced throughout the entire lease/sale process. Some of the most relevant specs that should be mentioned are:

- Property type (single- or multi-tenant)

- Total square footage and available space square footage/size

- Year built/renovated

- Floorplans and potential configurations

- Grade-level doors and loading docks

- Clear height and column spacing

- Electric, lighting and sprinkler/fire suppression systems

- HVAC systems (potential key amenity, depending on operators’ specific needs)

In addition to the standard lease type and rate, other essential factors for industrial occupiers are:

- Loading capacity: to meet both the receiving and distribution needs of the operator

- Floor load requirements: to support any excessive weight from the operator’s equipment

- Parking lot capacity: to accommodate operational needs (trucking requirements), as well as employee and visitor needs

- Building certifications: to indicate the property’s energy efficiency and the owner’s/ landlord’s sustainability efforts

- Site plans and current tenants: to determine if the property is part of an industrial park

Visual & Interactive Content

Creative visuals provide prospects with a better overall image of the property by ensuring an immersive experience that allows the user to explore the surroundings, community amenities and demographic information up close. Among the most important are:

- High-quality imagery, which includes professional photographs and renderings, draws attention to the property’s best attributes by capturing and sharing the character of the building.

- Fine-tuned video content that includes exterior and interior footage to emphasize configuration and possible space uses. Well-crafted aerial drone footage can highlight location and site layout especially well/efficiently.

- Self-guided virtual tours featuring interactive floorplans that enable prospects to evaluate building characteristics and amenities without having to be physically on-site.

- Integrated inquiry forms that allow prospects to get in contact and ask for extra information such as rental rates and current availability.

CRE Solutions Fuel Efficiency

Despite shifting CRE fundamentals, the industrial sector is expected to remain strong, and availabilities will continue to be highly sought after. Subsequently, an efficient marketing strategy should rely on tools that maximize listing exposure.

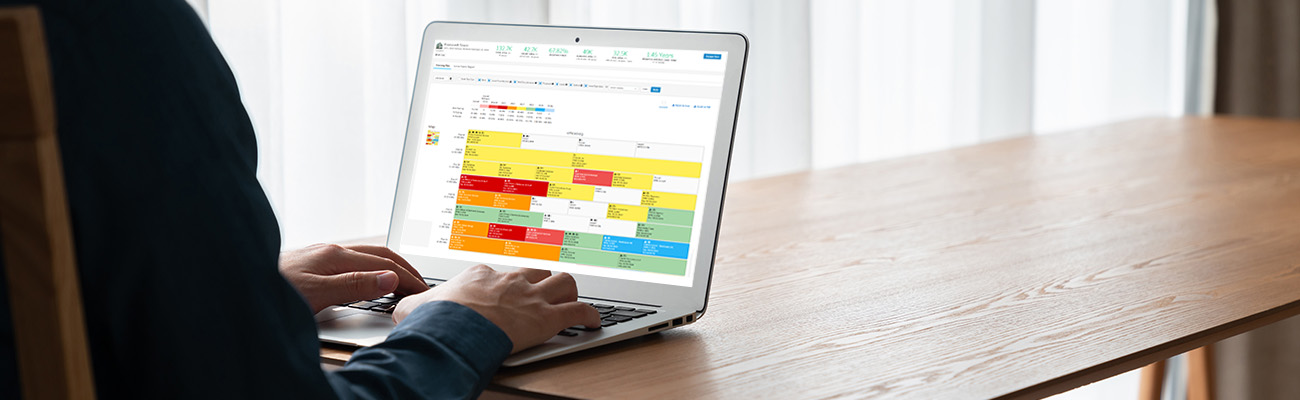

For instance, CRE solutions such as CommercialEdge Marketing — part of the CommercialEdge solution stack — elevate the outreach process by enabling effortless listing marketing and management, as well as generating qualified leads.

Specifically, listings published through CommercialEdge Marketing are automatically distributed to the CommercialEdge Listing Network, which encompasses marketplaces such as CommercialCafe, CommercialSearch and PropertyShark, and generates more than 2 million monthly visits and over 350,000 verified leads yearly. For greater exposure, listings can also be promoted on the network with featured ads.

Through Marketing, listings can be syndicated to leading third-party marketplaces as well as a company’s corporate website. What’s more, the marketing solution can be used to create branded property websites populated with information already provided in Marketing. Listings can be managed from one connected hub while users maintain complete ownership of their marketing data.

For promotional materials, Marketing provides a full-service marketing team that users can work with to capture photos, create virtual tours and generate bespoke brochures based on property and space content.

Furthermore, the marketing solution is fully integrated with Yardi Voyager, elevating it to dynamic marketing. Voyager users can synchronize their properties, spaces and availabilities across their portfolios. As a result, listings are automatically published based on lease expirations and automatically unpublished as soon as a tenant is activated in Voyager.

The process of putting together a comprehensive industrial listing should be underpinned by selecting the appropriate marketing platform that ensures visibility and delivers accurate and up-to-date information to the target audience. Relying on solutions that help streamline these operations should be key amid dynamic market conditions, especially considering the tight competition that is expected to continue to drive the industrial sector going forward.

More Articles You Might Like

BOMA Advocacy Report: The Impact of Transfer Taxes on Commercial Real Estate

The BOMA Advocacy Report on Transfer Taxes examines the effects of real estate transfer taxes (RETTs) on commercial properties across the U.S.

Understanding Stacking Plans and Their Importance in Commercial Real Estate

Stacking plans are valuable tools in CRE leasing and asset management, especially with a dedicated solution that automates their creation.

Manufacturing Growth Set to Fuel Industrial Space Demand

The manufacturing sector is expected to remain a key driver of industrial development, though not without challenges.