How to Find Recently Sold Commercial Real Estate and Enhance Strategic Decision-Making

Access to accurate and timely property data provides a solid competitive advantage in the CRE industry. A key step for streamlining the deal-making process is learning how to find recently sold commercial real estate with minimal effort.

Use Public Records to Identify Recent Property Transactions

Searching for recently sold properties within a specific country or city using public records is usually straightforward. Many county recorders and assessors provide public access to property records and offer essential information like transaction and ownership history. A notable example is The Automated City Register Information System (ACRIS), a reliable source of public property records for New York City.

While this method is publicly available and generally free of charge, it comes with potential shortcomings such as incomplete, inaccurate or outdated information, limited property details and a reliance on local regulations in each area.

For a more accurate and in-depth research process, real estate professionals can opt for dedicated online databases. Numerous providers offer access to databases with up-to-date and comprehensive property information covering a wide array of markets and asset classes.

Tap Into Insights on Recently Sold Commercial Properties to Boost CRE Strategies

Knowing how to find recently sold commercial real estate information can benefit real estate professionals in several ways. Recent sales data on commercial properties provides valuable insights for:

- Market trends: Examining recent property sales can ensure a better understanding of current market dynamics, including property value trends and demand for certain properties.

- Informed decision-making: Information on recent CRE transactions supports strategic decision-making and uncovers investment opportunities by helping to assess the performance of different properties and locations.

- Financing and valuation: Recent sales data impact financing and investment decisions, as lenders and investors use this information to assess a property’s risk and return, which can impact the terms of financing or investment offers.

- Comparative analysis: Comparing recently sold properties with similar ones in the area can help determine the current market value of a commercial property and better understand pricing dynamics.

Leverage Best Practices to Compare Similar Properties

Analyzing recently sold commercial property data is key to understanding market trends. These are some of the best practices to follow:

- Define your search criteria

To ensure a precise research process, start by defining the specific criteria for the commercial properties you are interested in, such as:

- Property type (office, retail, industrial) and class

- Size and layout (square footage, usable space, number of floors)

- Year built and location

- Amenities and accessibility

- Zoning regulations and land use restrictions

- Leverage the power of online databases and platforms

Use online databases and platforms to conduct a comparative analysis of CRE listings and sales information. These resources enhance the research process through automation and provide access to a wide range of data, which can be narrowed down using search filters.

- Filter and compare properties

Use filters to narrow down your search results based on your criteria. Once you have a list of properties matching your requirements, compare them based on factors such as sale price, price per square foot, location, condition and other relevant details.

- Evaluate financial performance

In addition to comparing the sale prices of similar properties, evaluate their financial performance by taking into account metrics such as rental income, occupancy rates, operating expenses and potential for future appreciation. This analysis can help with assessing the investment potential of each property.

Work with Online Databases to Simplify the Research Process

Accessing accurate property data is now easier with numerous online property databases available. These platforms facilitate access to property listings, transaction details and ownership information on a national scale. Some specialize in commercial sectors, such as retail, office spaces or industrial properties, while others cover all asset types. Notable examples include CommercialEdge Research, PropertyShark, Yardi Matrix, CoStar, Reonomy, Buildout.

CommercialEdge Research stands out by providing access to extensive CRE data covering more than 14 million property records and over 8 million recent transactions with nationwide coverage across all asset types. The platform facilitates comparables analysis with a quick and easy-to-use comps tool that delivers up-to-date results.

Here’s how CommercialEdge Research can optimize the research process, including identifying recently sold CRE properties:

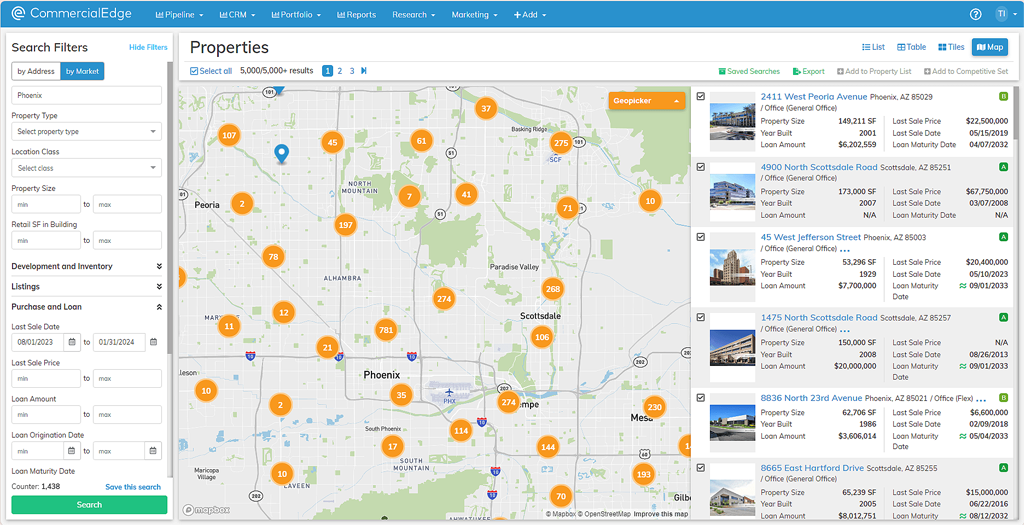

Perform a property search

Perform a property search based on location by selecting a market, city or address and a period for the specific sale dates to receive the complete list of recently sold assets in the specified area.

Narrow down search results using other available filters, including:

- Property type

- Location class

- Property size

- Year built

- And more

Search results can then be used either by saving the list as it is, selecting specific properties and adding them to a list or a competitive set, or exporting the list to a PDF, Excel or other file formats.

Use the map view

Gain a visual overview of recent sales within a specific area with the Maps functionality. Applying the sale date filter will populate the map with color-coded sales data, enabling you to quickly identify areas where properties haven’t changed hands in a while or pinpoint hotspots for property sales. You can also refine your search by property type for a visual representation of sales data in your submarket of interest.

This tool provides quick access to information about each property with a simple click, eliminating the need to access individual property reports.

Accurate property data is essential to strategic planning and decision-making in commercial real estate. Solutions such as CommercialEdge accelerate processes and save time by enabling real estate professionals to streamline their dealmaking.

Disclaimer

This guide aims to provide potential investors with sufficient information to determine if they are interested in pursuing discussions regarding a purchase or other transactions. Investors are encouraged to conduct their own analysis, inspection and examination and should rely solely on their own findings when determining their course of action.

More Articles You Might Like

Understanding Stacking Plans and Their Importance in Commercial Real Estate

Stacking plans are valuable tools in CRE leasing and asset management, especially with a dedicated solution that automates their creation.

Manufacturing Growth Set to Fuel Industrial Space Demand

The manufacturing sector is expected to remain a key driver of industrial development, though not without challenges.

Office Utilization Shifts Bring Down Property Valuations

The office sector continues to see valuations on a downward trend, as the market navigates the rise of the remote and hybrid work models.