Global Medical REIT Streamlines Deal Flow and Portfolio-Wide Reporting with Deal Manager

The Company: Global Medical REIT

Headquartered in Bethesda, Maryland, Global Medical REIT is a net-lease medical office real estate investment trust. With a portfolio exceeding 4.9 million square feet across the U.S. as reported as of Sept. 30, 2022, the REIT acquires and leases purpose-built healthcare facilities to leading healthcare systems and physician groups.

The company’s disciplined investment strategy focuses on uncovering high retention and patient-centric acquisition opportunities in premier secondary markets bolstered by favorable demographic and decentralization trends. Through this approach, Global Medical REIT consistently provides strong returns for its shareholders and ensures lasting relationships with its tenants.

The Challenge: Limited Portfolio Reporting and Multiple Systems

With 189 medical properties across the U.S., Global Medical REIT strives for total transparency and requires access to portfolio-wide reporting for easy data access across teams that streamlines leasing activities and deal flow processes.

Before implementing CommercialEdge Deal Manager, the firm encountered difficulties with its previous solution due to high costs and the lack of access to portfolio-wide reporting, leading to inefficiencies in their deal management processes. Additionally, the tool lacked the possibility of business-wide process integration, which resulted in discrepancies in the leasing data.

The Solution: Access to On-Demand Data and Detailed Reporting

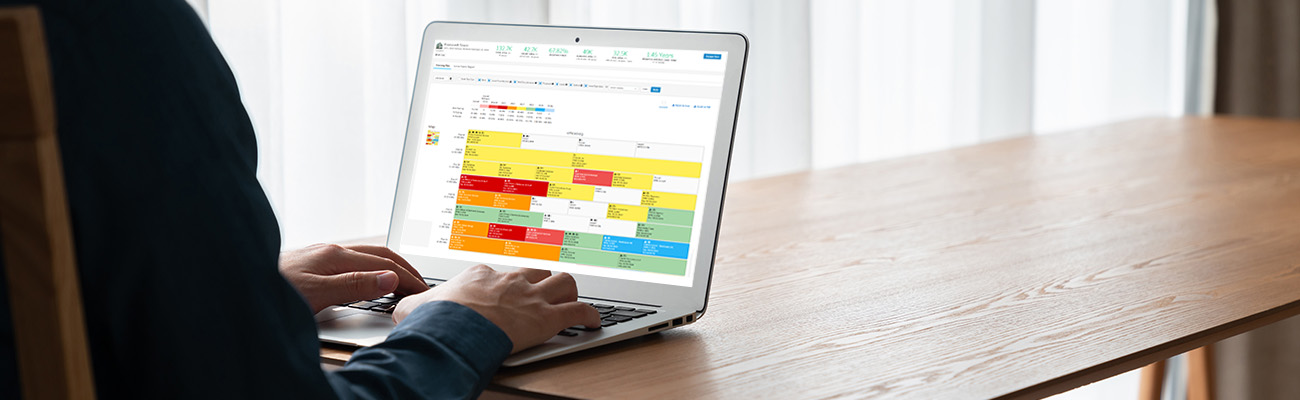

Deal Manager, part of the CommercialEdge solution suite, is a leading CRM and deal-making software offering full transparency and visibility into deal metrics throughout the lease lifecycle. Key metrics can be viewed on demand for proposal evaluations and more, while detailed reporting provides actionable insights and helps with performance analysis by property, market, agent and other attributes.

By integrating Deal Manager with Yardi property management software, clients gain real-time tenant- and lease-level data such as schedules, expenses and clauses, as well as access to current unit availability, floor plans and interactive stacking plans. This integration streamlines communication and enables clients to enter deal terms, track proposals and calculate and store net effective rent at the deal level.

“Deal Manager has helped us streamline our leasing activity and deal flow. The system has facilitated better communication and coordination between brokers and internal decision-makers, and the integration with Voyager has automated processes, which has increased productivity.”

Daniel Magney, Asset Manager, Global Medical REIT

The Story: One Connected Solution with Portfolio-Wide Reporting and Insights

As a Yardi client since 2018, Global Medical REIT was already an active user of Yardi Voyager and, by adding Deal Manager, the company found the answer to its portfolio-wide reporting challenges. Moreover, this one connected solution helped the firm streamline its leasing activity and deal flow.

“Deal Manager provides an excellent tracking system for busy asset managers and brokers and greatly assists with the progression of the deal as well as the analysis needed to make good leasing decisions. Since we are already Yardi users, it is an efficient way to assist in our budget forecast program. This program is also very intuitive for our users and requires little handholding with third-party users.”

Dawna Powell, VP, Asset Management, Global Medical REIT

Easy and fast access to accurate leasing data

Thanks to Deal Manager, the Global Medical REIT accounting team is more self-sufficient and can access leasing activity without asking the asset management team for information.

Global Medical REIT captures every property’s activity across its portfolio and can provide reports to investors with greater speed and accuracy. At the same time, working with external brokers is also easier due to the tool’s intuitive interface, which requires little training and ensures effective collaboration for all parties involved.

Seamless implementation

Since smoothly transitioning from its previous system to Deal Manager, Global Medical REIT can generate portfolio-wide reports and has a complete pipeline overview, all in one place. The company was able to transfer all its deals and go live with Deal Manager in just a matter of weeks.

“Deal Manager provides our organization with a cost-effective tool that enables us to manage our leasing pipeline, all in an easy-to-use interface. The Yardi team made the implementation quick and easy; we were able to go live in a few weeks.”

Sean Tu, SVP of Asset Management, Global Medical REIT

More Articles You Might Like

Understanding Stacking Plans and Their Importance in Commercial Real Estate

Stacking plans are valuable tools in CRE leasing and asset management, especially with a dedicated solution that automates their creation.

Manufacturing Growth Set to Fuel Industrial Space Demand

The manufacturing sector is expected to remain a key driver of industrial development, though not without challenges.

Office Utilization Shifts Bring Down Property Valuations

The office sector continues to see valuations on a downward trend, as the market navigates the rise of the remote and hybrid work models.