5 Effective Commission Split Plans for Commercial Real Estate Brokerages to Consider

Agent compensation is one of the most important factors to consider when assessing how to organize and structure a commercial real estate brokerage.

Structuring split plans strategically is critical to recruiting and retaining top talent in the industry. For example, if a top producer feels insufficiently compensated for the business they generate, they will be much more likely to switch to another brokerage willing to hold their license with a more favorable split plan.

CommercialEdge Commissions has analyzed hundreds of unique split plans across thousands of commercial real estate agents. Having processed over $500M in gross commissions (as of December 2022) and distributions to the house and agents, we found five common split structures worth considering.

Flat Rate Plans

Flat rate plans are commission structures with a fixed percentage share between the house and each agent on their gross. These splits are widely used because they are easy to calculate and forecast for the brokerage. However, top producers might become frustrated as regardless of how much they produce (while also covering their desk cost), they still give the brokerage house a percentage of their gross commissions.

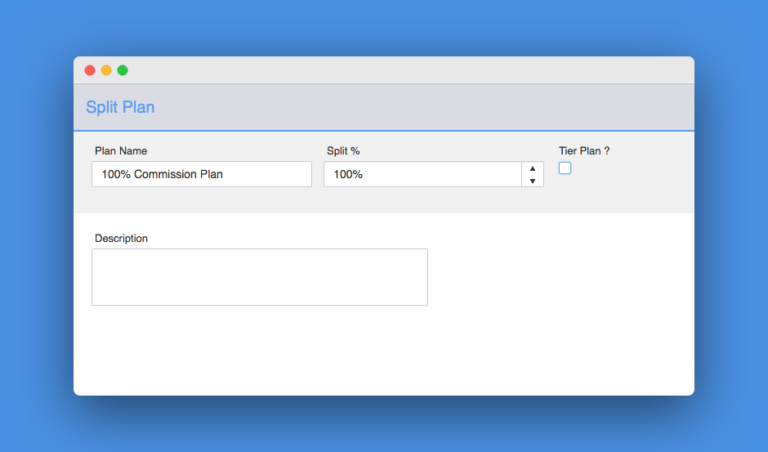

100% Commission Plans

The 100% commission plan was first popularized by RE/MAX. With this split, the broker receives 100% of the gross commission they bring in. This plan may sound great on the surface, especially regarding agent satisfaction, but it limits revenue for the brokerage house. In these situations, the firm collects expenses and desk costs either as an annual or monthly fee but doesn’t participate in the actual share of the commission.

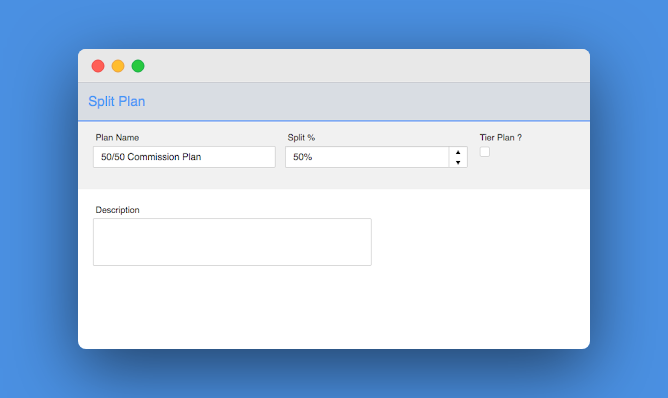

50/50 Split Plans

The 50/50 split plan’s adoption rate also relies on ease of implementation. For every dollar of gross commission an agent produces, $0.50 goes to the house and $0.50 goes to the agent. Typically, with these plans, the agent does not pay for any of their desk costs, and the brokerage covers operational expenses like signs, marketing materials, administrative assistants and more.

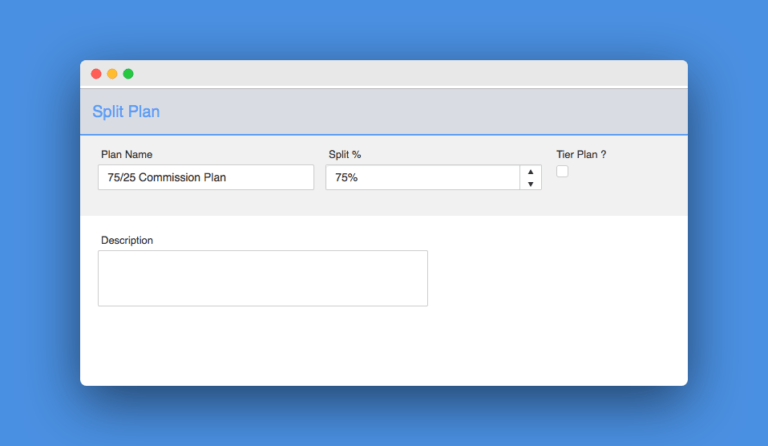

Other Flat Rate Plans

Of course, brokerages will often use different rates than the standard 50/50 plan. Some will incentivize top producers to join their businesses by offering better flat rates than their current brokerages, with these plans ranging from a 60/40 split all the way to 90/10.

In the latter example, if a broker brought in $100K in gross commissions, they would keep $90K while the house would receive $10K. When considering plans with that high of a percentage, it’s recommended to assess the desk cost for each agent and whether you will need to bill your brokers/agents for expenses.

Tiered Commission Plans

To remain competitive in the job market, brokerages have become more and more sophisticated in structuring their commission plans. And with tiered split plans, brokers keep an increasing amount of their gross commission throughout the year — provided their productivity rises during this time.

Tiered split plans typically start with the broker keeping 50-60% of their gross. This share then increases as brokers hit new tiers or breakpoints. The most common breakpoints are tied either to the agent’s overall gross production or the net they keep.

Essentially, tiered commission plans allow brokerages to keep a high percentage of the commissions until the broker has covered their desk costs. Then, the share earned by the broker increases as they create more and more income for themselves and the business.

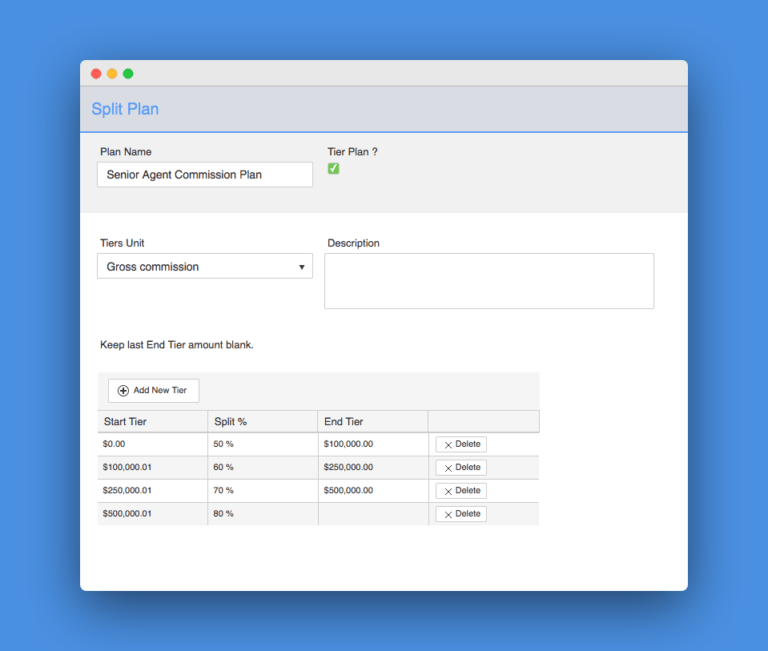

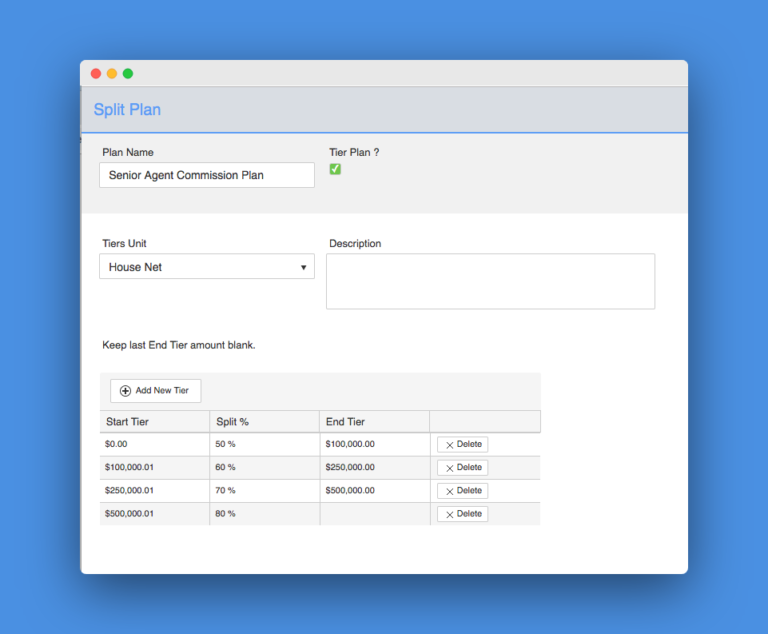

To illustrate how tiered commission plans work in practice, we simulated a four-tier scenario in two situations, tying the breakpoints first to gross commissions and then to agent net:

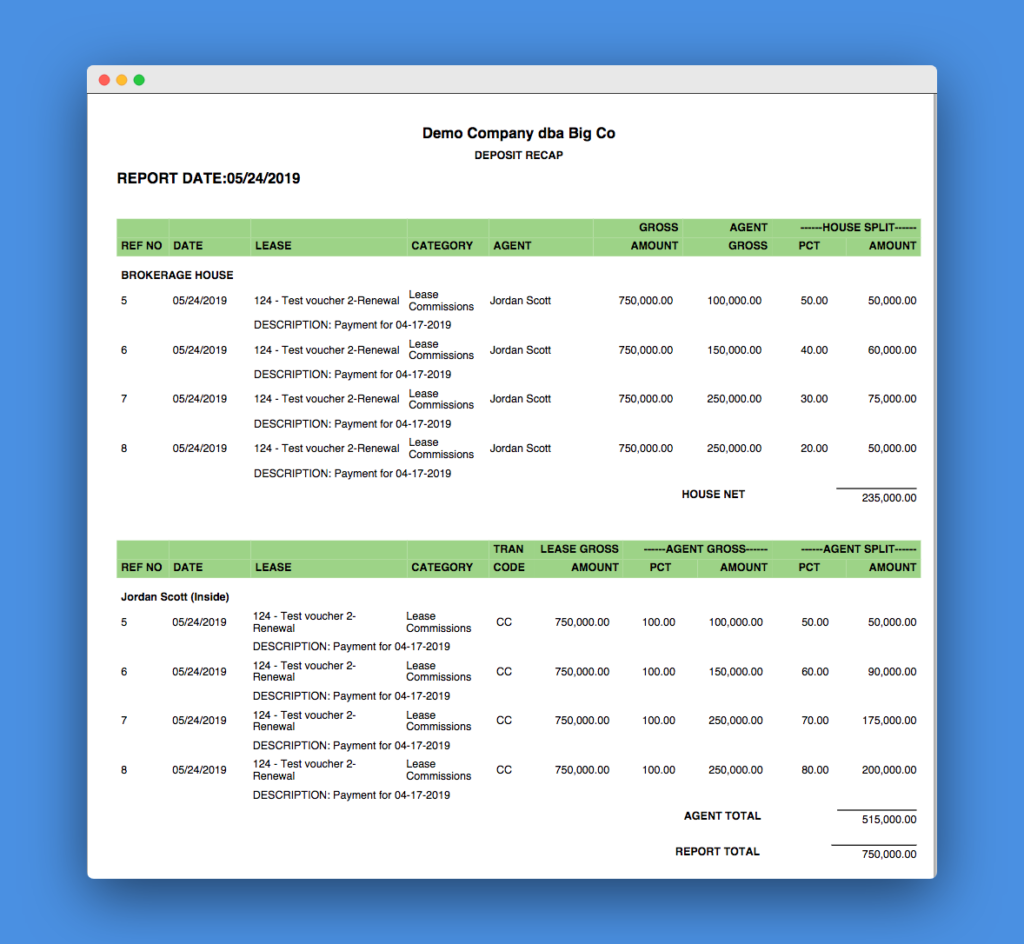

Gross Commission Breakpoints

The most common breakpoint is based on the gross commissions created by agents. With this type of tiered plan, a brokerage will distribute all revenue collected through a particular deal according to individual agent split plans applied to their gross earnings. In practice, if a broker brought in a $750K gross commission deal, the split would be calculated as follows:

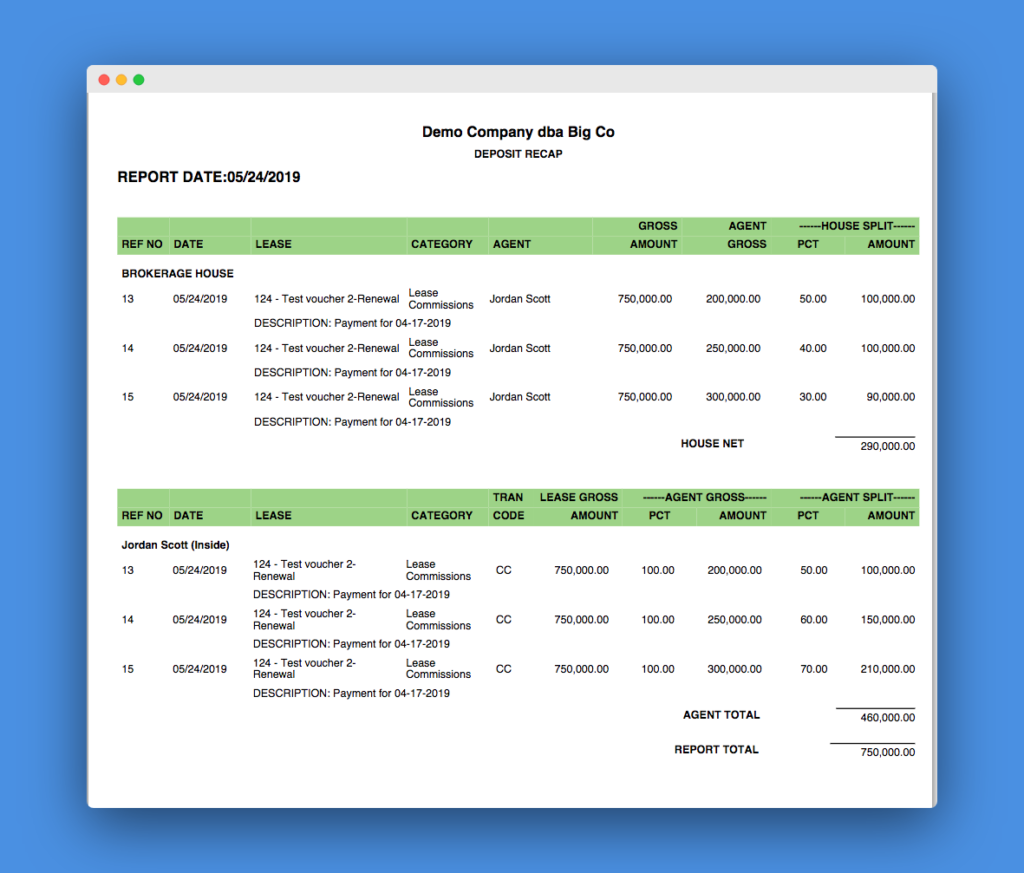

House Net Breakpoints

The house net plan is distributed similarly to the gross-tiered structure, with one key difference: agents reach different breakpoints based on how much net they produce for the house as opposed to the overall gross of the deal. As such, a $750K deal would be distributed quite differently according to this plan, with the brokerage keeping more of the commission over time:

Impact of Tiered Split Plans

Overall, tiered split plans are an efficient method of revenue distribution that incentivizes agents to maintain productivity and speed up deal cycles. However, they can come with operational challenges. For example, if a brokerage has 15 agents on board and uses different tier structures for junior agents, senior agents and principals of the firm, keeping up with distribution calculations and updating agents on their split plans can become a daunting, resource-burning task.

Other Ideas to Consider

With or without tiered plans, some brokerages are also using more complex types of distribution to remain competitive. For example, some firms employ manager overrides, bonuses and other incentives to motivate their team. Others offer a recruitment bonus adapted to the CRE market: when an agent brings in someone new, they will get a bonus whenever the broker they recruited commissions.

However, bonuses can be painful to manage, especially as each agent statement needs to offer complete transparency. Brokers want access to a full breakdown of their earnings on each deal, including how the calculations were made.

Including Expenses

Expense calculations should also be considered regardless of the commission plan a brokerage chooses, as there may be times when agent earnings are reduced by the resources they consume. Providing brokers with a detailed statement or a portal where they can view past statements and income will increase transparency and trust, especially when complex split plans are in place.

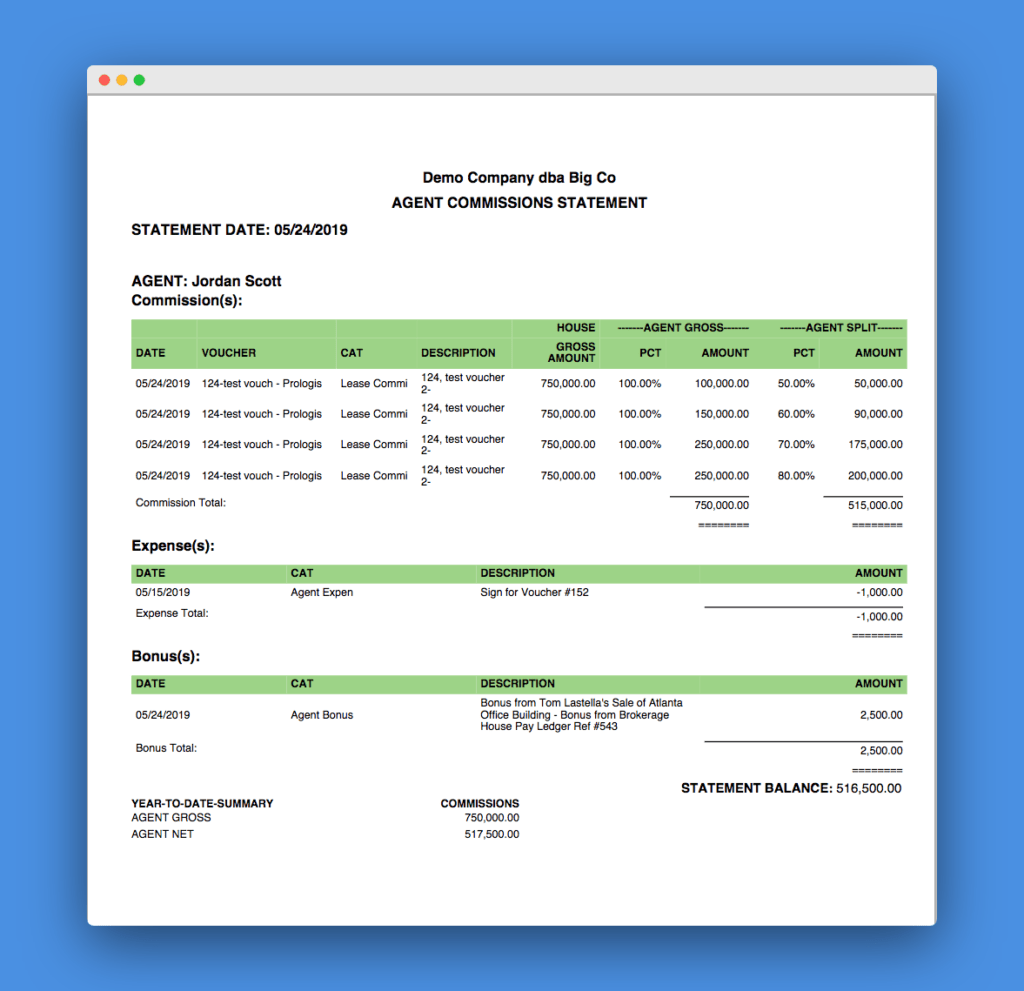

Transparent Agent Statements

To illustrate a fully transparent commission process for an agent, we simulated a statement that includes bonuses and expenses. Agent statements should be clear and detailed and have references for each item, so brokers can see why they were paid a certain amount — and cross-check any expenses if need be.

Efficient Commission Management

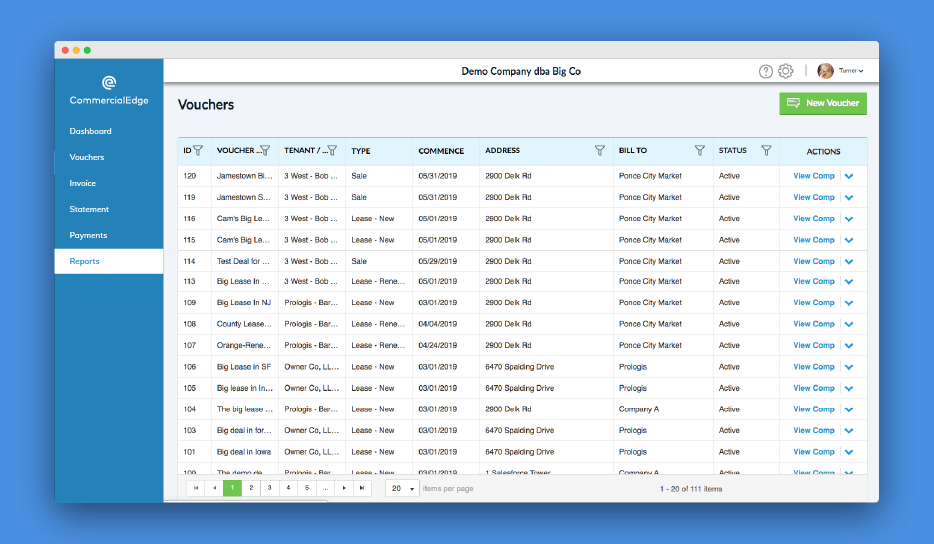

But what’s the best way to increase back-office efficiency and transparency simultaneously? Many brokerages are taking operations one step further by implementing a dedicated commission management platform, such as CommercialEdge Commissions.

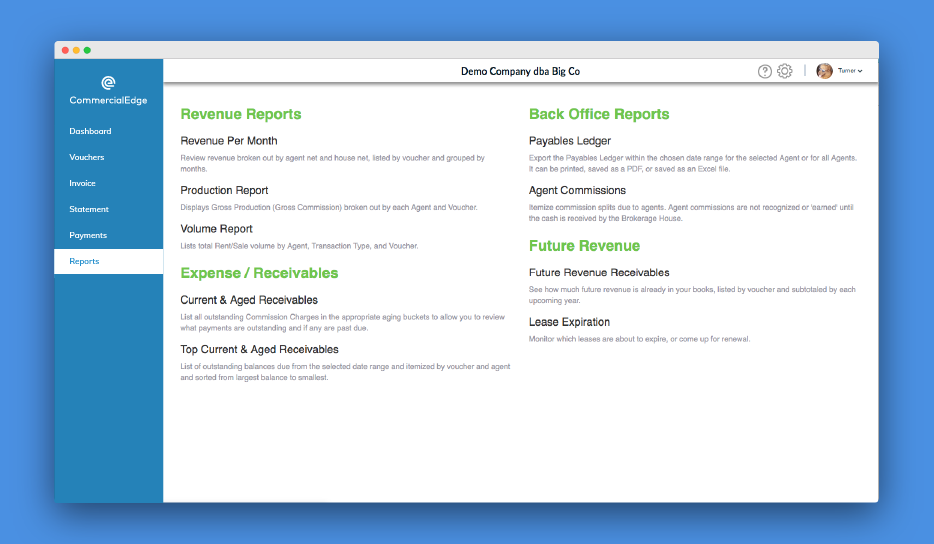

Solutions like Commissions offer agents a place to view and evaluate all of their statements, receivables and more. These platforms will also eliminate the need for spreadsheets and manual calculations, automating every step from the initial voucher and distribution to the final invoices. Commissions, for example, supports any type of split structure, including the most complex of tiered plans.

Furthermore, to save time and resources in both the accounting and management teams, the platform offers customizable approval workflows that are easy to set up and apply to individual deals.

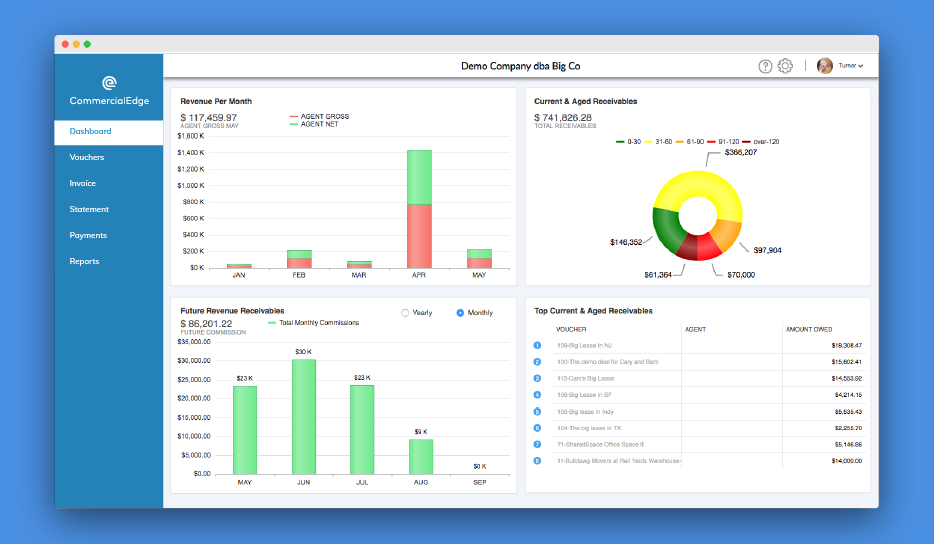

Commissions also includes a real-time, global analytics dashboard with vital revenue and production information, as well as customizable, downloadable reports.

When upgrading your technology stack, remember to ask the hard questions of your potential vendors. Careful consideration is especially important when operations that include broker finances are involved. Commissions platforms should centralize and accelerate processes, support complex calculations and integrate with accounting platforms seamlessly.

With the right software, distribution workflows that generally take days of individual calculations in spreadsheets can be reduced to a couple of hours of work.

More Articles You Might Like

BOMA Advocacy Report: The Impact of Transfer Taxes on Commercial Real Estate

The BOMA Advocacy Report on Transfer Taxes examines the effects of real estate transfer taxes (RETTs) on commercial properties across the U.S.

Understanding Stacking Plans and Their Importance in Commercial Real Estate

Stacking plans are valuable tools in CRE leasing and asset management, especially with a dedicated solution that automates their creation.

Manufacturing Growth Set to Fuel Industrial Space Demand

The manufacturing sector is expected to remain a key driver of industrial development, though not without challenges.